How To Create A Custom Wealth Plan That Makes You Your Own Banker.

Three questions that can change how you view your money:

- Do you want to be wealthy?

- Do you want to control your money and where it goes?

- Do you live in Ontario?

If you answered yes to all three, book your free discovery today, so you can secure your family, your future & your financial success.

Why Is Your Wealth Plan Important?

(Step 1) Discovery Call: Envisioning Your Future

We start with a discovery call to pinpoint your financial and lifestyle ambitions, assessing the costs to achieve them realistically. This initial step ensures we understand your goals thoroughly, setting the stage for personalized planning.

(Step 2) Create and Crafting Your Wealth Plan

Next, we craft your Wealth Plan by conducting a detailed review of your personalized financial plan. Built on a foundation of trust, we ensure a comprehensive evaluation before suggesting any adjustments or strategies, aiming for clarity and confidence in every decision.

(Step 3) Implementation and Review: Staying on Course

Life’s inevitable changes mean your financial plan must be dynamic. MJH Financial is committed to regular reviews and updates of your Wealth Plan, ensuring it evolves with your changing needs and goals. Through every shift, we’re here to keep you aligned with your financial success.

We Offer You

Customized Financial Planning

Infinite Banking Concept

Coaching and Consulting

Your advice as simple as it was, has helped us realize real savings and peace of mind for budgeting. Funny enough, we monitor our spending a lot less and the plan is working better… thank you for your advice BIG TIME!

– Ben L

Why Is Your Wealth Plan Important?

Your personalized financial roadmap is like a unique wealth plan. We help you support your aspirations, we help you secure and master your financial future. We can help you achieve this with 3 simple steps.

Learn how you can take control of your money the smart way:

Download My Free eBook nowHow To Create A Wealth Plan…

No Matter What Your Age Or Income

Early Years: Setting the Course

In the early stages of your career, establishing a financial plan helps steer you towards long-term success, guiding decisions on savings, investments, and debt management. It lays the groundwork for wealth building, ensuring every step supports your future goals. Tailored to your unique situation, it’s your roadmap from the outset.

Middle Years: Expanding Horizons

During your peak earning years, a financial plan is vital for balancing immediate needs with future aspirations, such as retirement readiness and supporting your children’s independence. It maximizes wealth growth and prepares you for the next life stage. This strategic approach keeps your financial goals on track and within reach.

Your Legacy: Adapting with Confidence

Life’s unpredictability demands a financial plan that’s both resilient and flexible. Whether facing unexpected challenges or welcoming positive changes, our wealth plan ensures your financial security and legacy are protected. It’s about adapting without losing sight of your goals, securing your financial future.

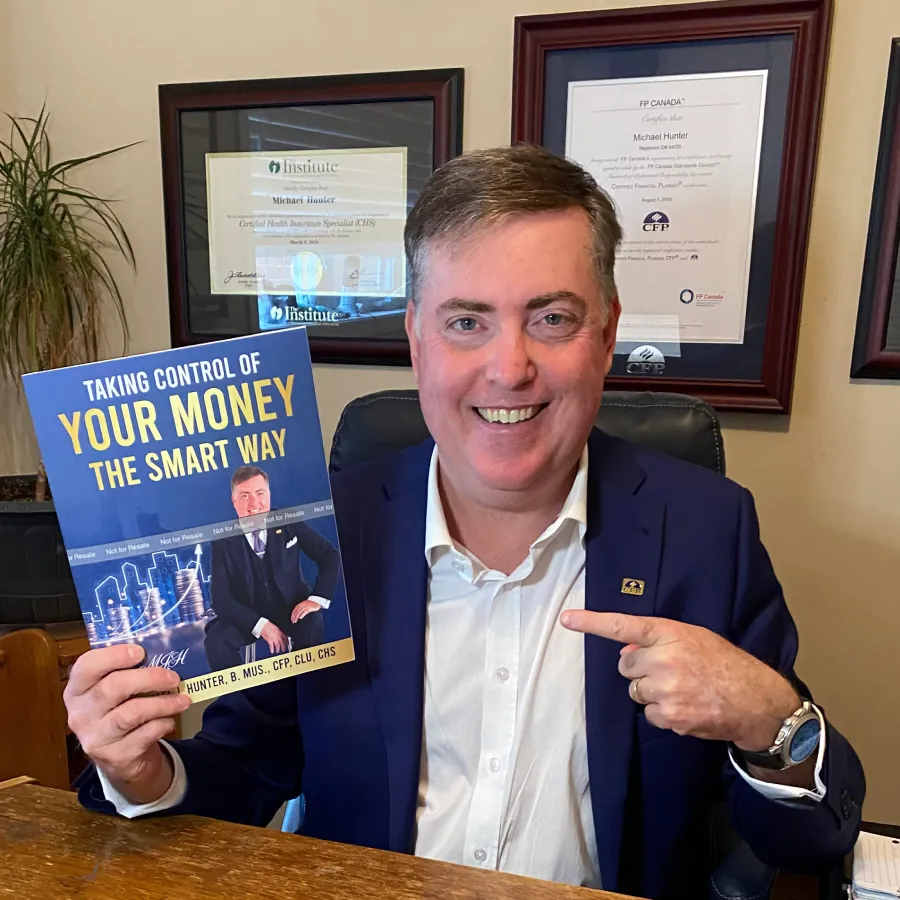

About Michael & Stephanie Hunter

Michael J. and Stephanie Hunter are a what people call Canada’s dynamic duo. They have seamlessly blended their personal and professional lives to create a powerhouse partnership that serves Canadians.

As a family of four, they have two children, they’ve found the perfect balance between nurturing their relationship, helping their two children achieve their goals and building a business that serves Canadians, especially people that live in Ontario.

Certifications

Schedule Your Discovery Call Now

We are happy to answer any and all your financial questions on the discovery call.

Book Your Free Discovery Now

Will Rogers said “I never met a man I didn’t like”, not I never met a man I didn’t trust. When it comes to your finances, you need someone who understands you and who you can trust. Like Will Rogers, we tend to like everyone, but we only work with a few. Our relationships are built on mutual understanding, respect, and trust. If you think we may be a good fit for you, please reach out. Our first meeting is always complimentary, we love talking shop.

– Michael J. Hunter, Founder.